Underpinning the negative media coverage of OneTaste following Ellen Huet’s June 2018 Bloomberg Businessweek article is the imputation that OneTaste exploited staff and students for money to get rich. She reported, based on accounts of a few disgruntled and mostly unnamed former employees, that OneTaste “ran on predatory sales” and that “management pushed employees to stop caring about their own money” and “used the workers to bring in more of others’ cash.” All subsequent reporting following the Bloomberg Businessweek piece strongly implied that OneTaste’s owner Nicole Daedone was seeking personal financial enrichment.

Nastaran Tavakoli-Far in November 2020 BBC podcast claims that “Nicole, in particular, was tired of them always being broke and things soon started to spiral into predatory sales tactics and $60,000 annual memberships.” Prior to the reporting by Bloomberg Businessweek and the BBC podcast, although there were nearly 100 pieces of media coverage of OneTaste, Bloomberg Businessweek was the first to suggest that the company’s modus operandi was to exploit people for personal financial gain. Many of these reporters attended the in-person workshops hosted by OneTaste in major cities across the United States and Western Europe.

The imputations made in the media have caused serious financial harm to OneTaste Inc. This led OneTaste, as well as the Institute of OM, Nicole Daedone and other individuals and companies to bring claims against the BBC in High Court of England and Wales.

Below is an excerpt from court filings on this matter, setting out the imputations that a reasonable listener would draw from the BBC’s podcast:

“(a)Under the false pretext of being a wellness organization promoting practices of self-care and empowerment for modern women, was in fact operated with the sole aim of making OneTaste and those that ran it, including the First and Second Claimants wealthy, by using practices and programs that knowingly and deliberately manipulated and exploited vulnerable women causing them irreparable damage and lifelong trauma.

(b) Implemented predatory sales tactics which financially and emotionally ruined members, including by (i) manipulating vulnerable women into (1) taking on huge, unaffordable, and unmanageable debt and (2) engaging in non-consensual sexual activity to pay for OneTaste courses; and (ii) by requiring members to pay the commissions they had earnt back to OneTaste.

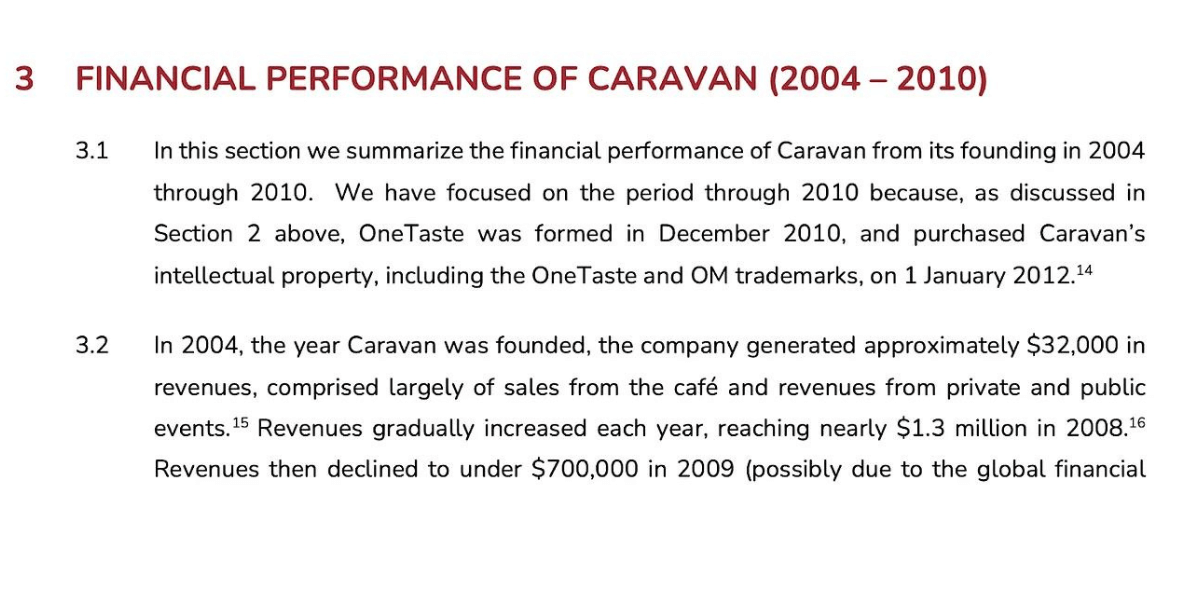

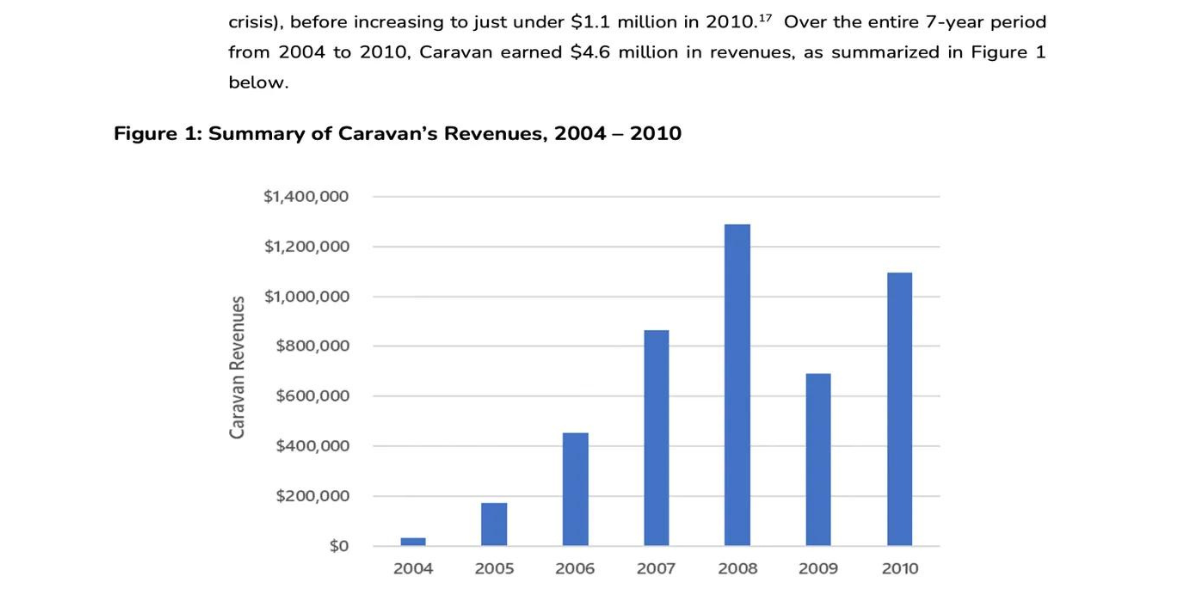

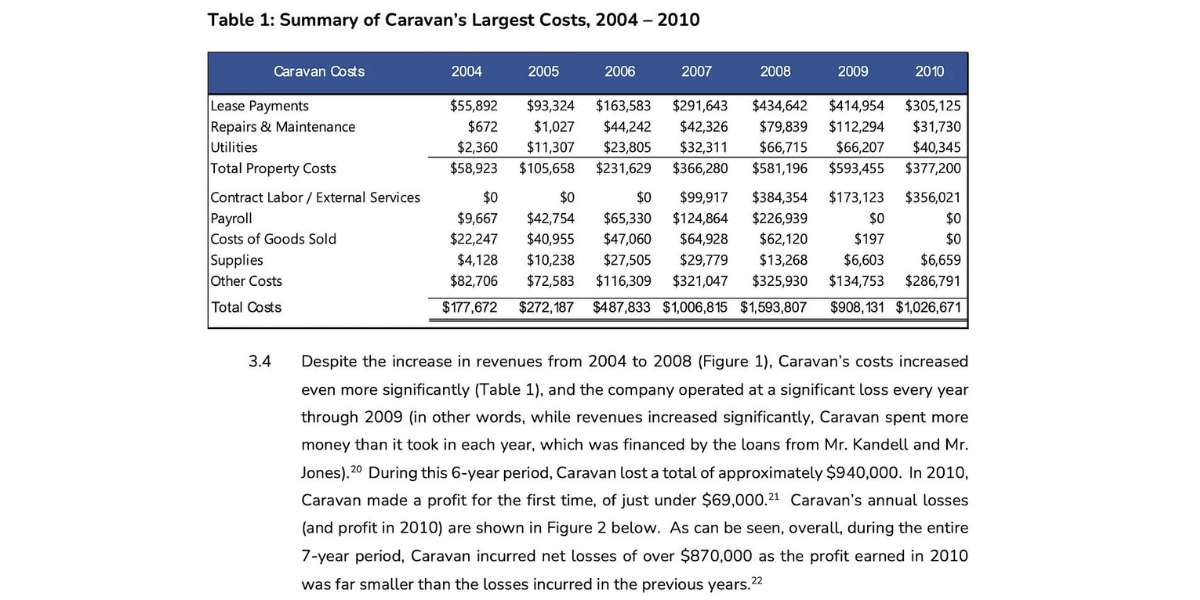

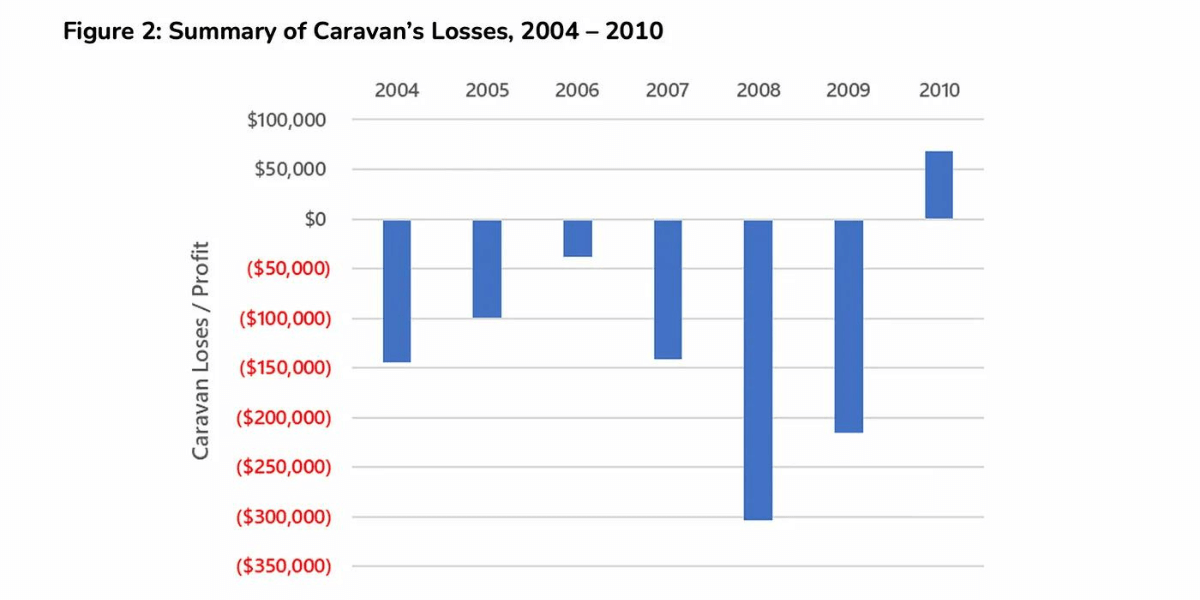

The allegations and imputations made about our organization simply do not match the facts. Below are excerpts from a detailed review of the finance and accounting records of OneTaste, prepared by a highly-regarded Washington DC-based third-party finance and accounting expert firm. The report covers the finances of OneTaste Inc and of its predecessor Caravan Retreats Inc (which traded as One Taste, An Urban Retreat Center, from 2004–2010).”

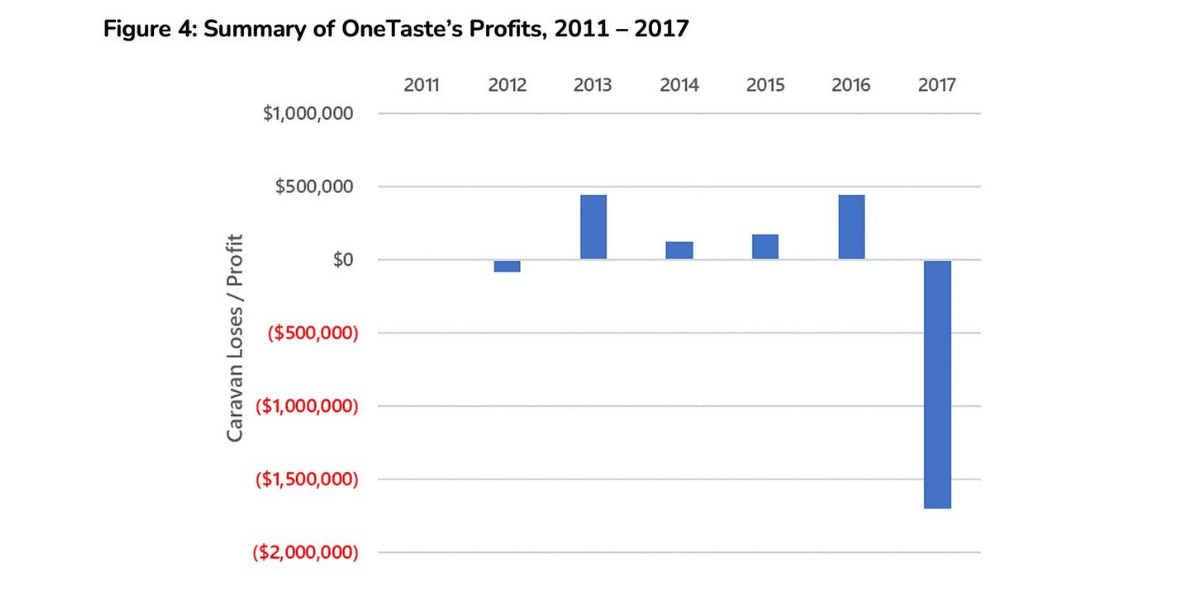

Caravan never made more than $447,000 in net revenue, and costs exceeded revenue in every year of operation until 2010.

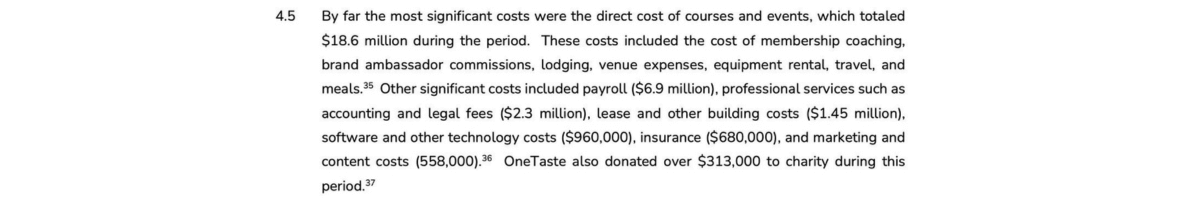

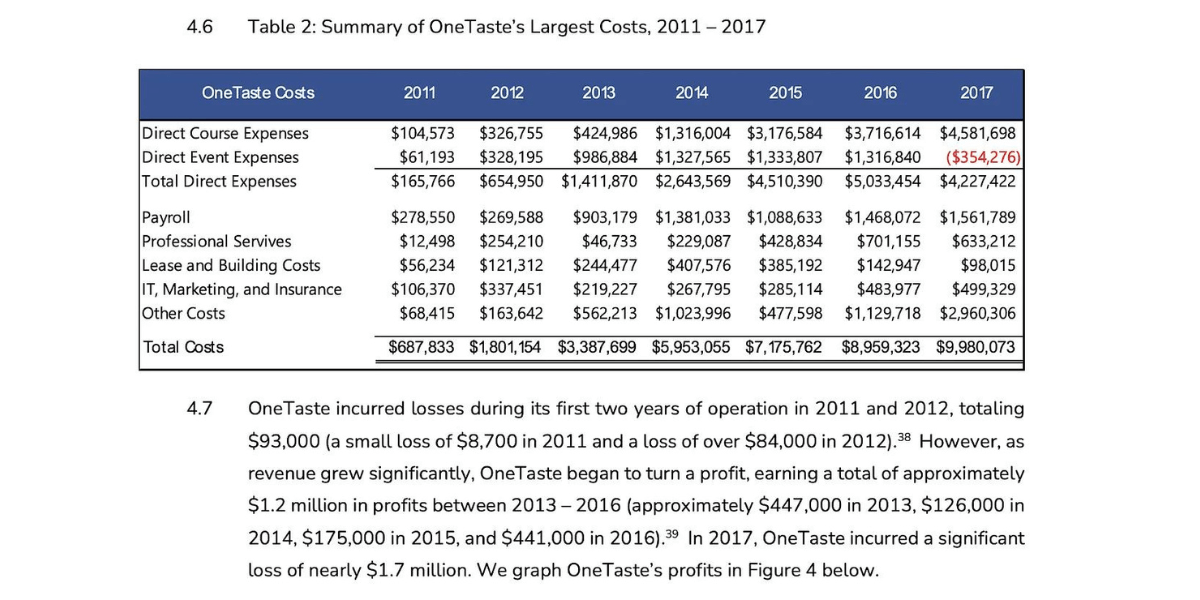

OneTaste Inc. was occasionally marginally profitable. However, the company incurred large operating costs associated with producing high-quality workshops and furthering the longer-term mission of making Orgasmic Meditation more widely available, including as a scientifically backed healing modality. OneTaste continually put revenues toward hiring outside experts to guest teach along with its own staff instructors, funded scientific research into Orgasmic Meditation, engaged in legislative efforts for the recognition of the practice, and made contributions to worthy charities. These costs, coupled with debt repayments and repurchasing equity, meant that there was no surplus generated.

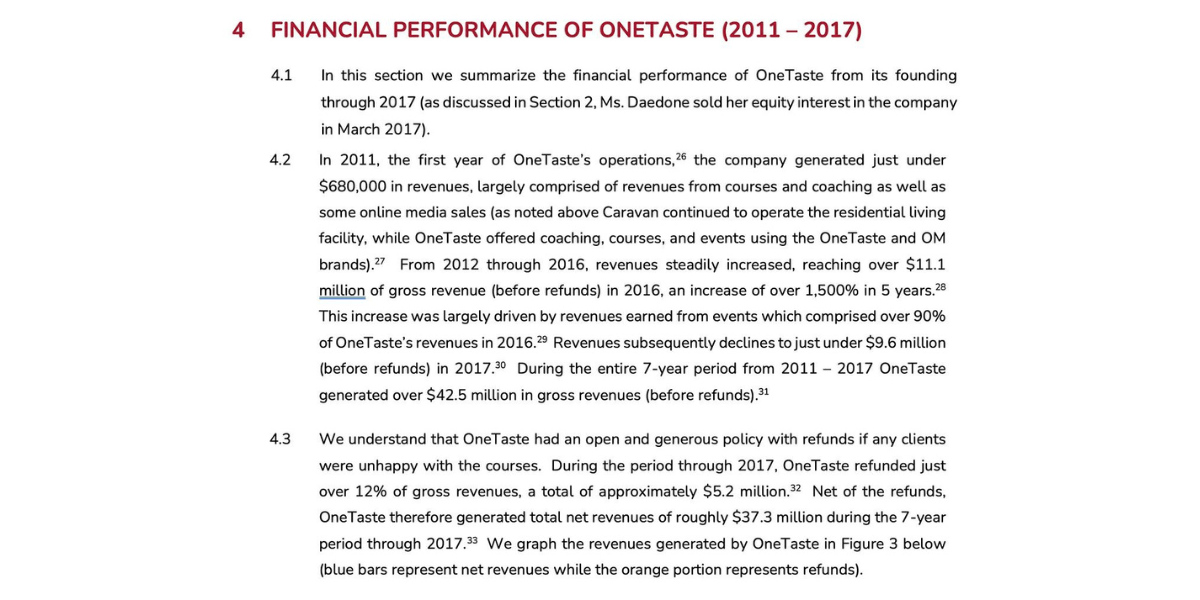

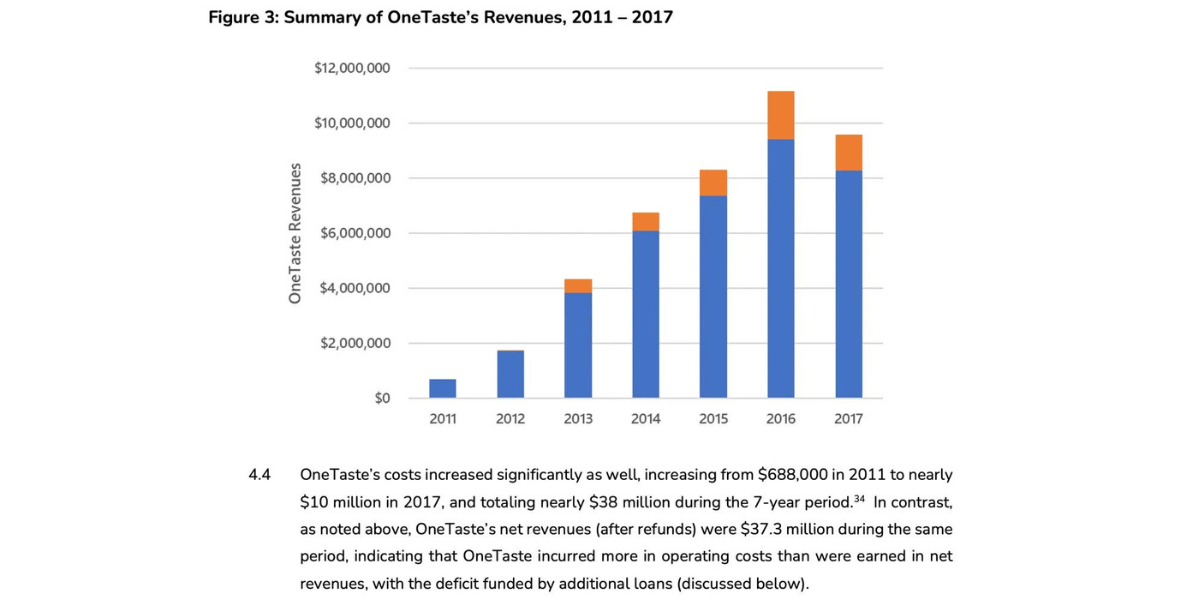

The third-party accounting report goes into more detail on OneTaste Inc.’s finances:

While OneTaste was profitable during the period 2013–2016, a significant portion of any cash generated by the company was used to repay the loans that had been used to finance Caravan’s earlier losses, as well as repurchasing equity in the company in 2014. The clear implication that would be drawn from adverse media about OneTaste following the Bloomberg Businessweek report is that OneTaste was making lots of profit from its courses, and the reader will be inclined to assume that Nicole Daedone, the co-founder, was pocketing it. Clearly, this was not the case.